On God, No Cap

For months, economists have been saying that inflation will rise due to Tariffs. Hard to take them seriously at this point.

With all these riots and protests, along with the reignited hostilities in the Middle East, I have almost forgotten about the state of the economy. For weeks on end, the only thing people seemed to complain about was President Trump’s day-one promise to fix the economy. They argued that he was failing on this front, emphasizing the excessive cost of eggs to support their point of view.

Senator Chuck Schumer urged action on the Senate floor for a comprehensive bird‑flu plan, warning that “higher egg prices” are a direct result of virus‑driven supply cuts. He emphasized the urgent need to spend allocated funds to stabilize prices. A group of nearly 30 House Democrats, led by Rep. Jimmy Gomez and the Congressional Dads Caucus, formally wrote to President Trump demanding action to “stabilize the egg supply” and curb soaring costs. Democrats, including Rep. Kristen McDonald Rivet (D‑MI), framed the eggs issue as a kitchen‑table concern, arguing that everyday expenses, like eggs, resonate more than abstract democratic issues.

Back in February, United States House of Representatives for Hawaii, Mazie Hirono, stated:

“Egg prices have skyrocketed. Bird flu is out of control. The USDA should be solving these problems. Instead, Trump is stacking the federal government with his cronies. He doesn’t care about your grocery bills,” adding that “Unfortunately, the price of groceries and eggs have only risen since Donald Trump took office.”

I have frequently wondered how a person can be dumber than Mazie Hirono. She is undoubtedly a row of crayons shy of a full box and is radically maladroit.

Over the past month, I have not heard any mention of the economy or the cost of eggs. Maybe because an overview of average U.S. consumer egg prices has shown that monthly consumer egg prices have dropped from $4.95 in January 2025, to around $2.52–$2.54 per dozen reported mid‑month June 2025.

It was just a few months ago when Jim Cramer warned of a potential market crash on par with Black Monday in 1987 unless Trump softened his stance or offered compensation to affected partners. Larry Summers, who served as United States Secretary of the Treasury from 1999 to 2001 and as the director of the National Economic Council from 2009 to 2010, called Trump’s tariffs “the most expensive and masochistic the US has pursued in decades,” warning they would hurt American families by raising prices and exacerbating inflation. He described the tariffs as a “self‑inflicted wound to the American economy,” predicting higher prices, decreased supply, and harm from retaliatory measures by Canada, China, and Mexico.

Last I checked, none of this has occurred to date. Now, as I often truthfully note, I am no economist; however, my friends who are astute in economics and finance frequently say that I align with the Austrian school of economics in my perspective. I believe I align more with the views of Milton Friedman and Thomas Sowell economically. However, they are more advanced theoretically than I am and would also argue that my primary theoretical economic principle rests on the “don’t have the loot, can’t spend the loot” mode of operation.

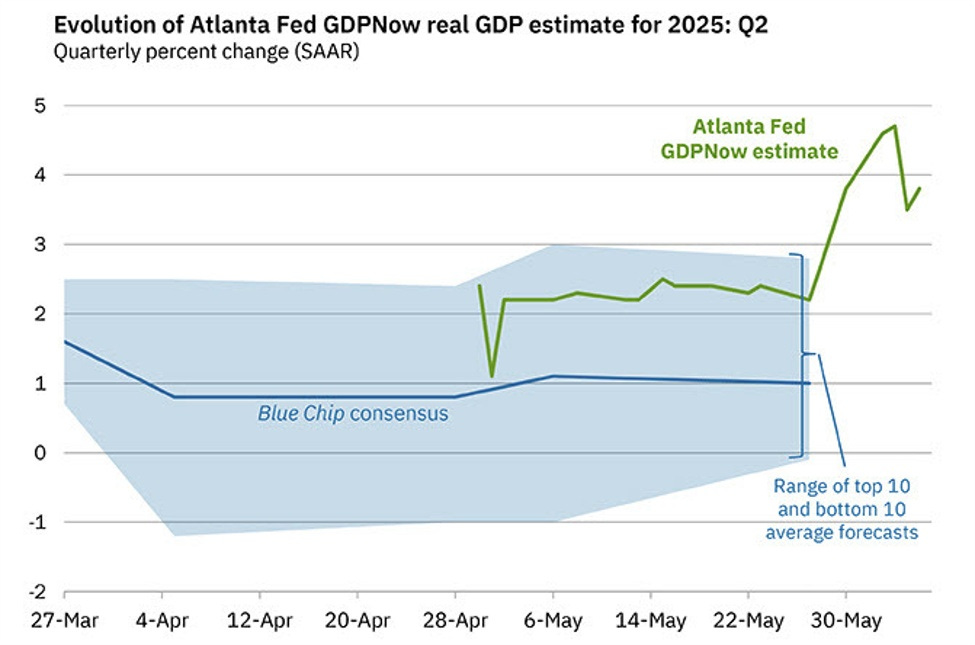

Based on this perspective, this is what I see now. As of June 17, 2025, the Atlanta Fed’s GDPNow model estimates that real GDP will grow at an annualized rate of 3.5% in the second quarter of 2025. Not too bad, seeing that the GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 was 3.8% on May 30, up from 2.2% on May 27.

True, the GDPNow model is a purely data-driven tool that updates in real time as new government and private sector economic data become available, without subjective judgment. This current estimate of 3.5% keeps the GDP trajectory in a moderate growth range for Q2, with some volatility earlier in the quarter driven by shifts in consumer activity, trade, and employment figures. Translation being, not bad, not bad at all.

Then there are the most recent job numbers. Nonfarm payroll employment rose by 139,000 jobs, close to the 12-month average and more than the projected rise of 125,000 nonfarm payrolls. Here’s looking at you, Jim Cramer and Larry Summers. Keeping it a buck, you need to subtract immigration numbers from the job numbers for a clearer picture. Biden was 240 - 240 = 0 for Americans. Trump is 140 - 60 (all legal) = 80,000 jobs for Americans.

What's notable about the job number is that we exceeded expectations on private sector jobs while reducing government jobs. Bigly. The Atlanta Fed is projecting 3.8% growth in the second quarter; that’s the real deal, mane.

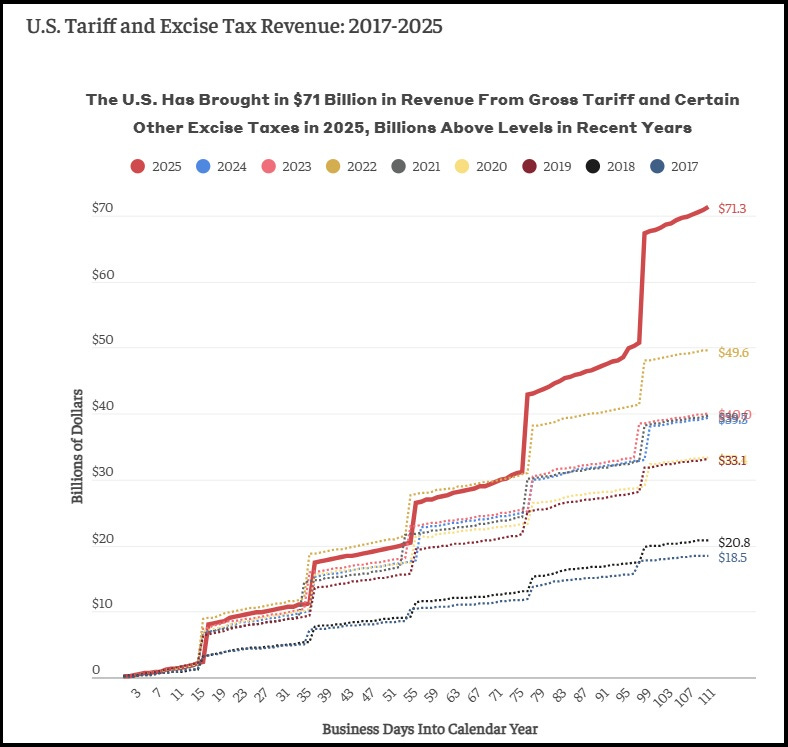

We cannot forget those pesky tariffs, which I went into historic detail on several months ago. Tariff collections have surged dramatically in recent years. In 2017, customs duties generated approximately $35 billion, rising to $41 billion in 2018 and peaking at $71 billion by 2019 under Trump’s first-term tariffs. The reintroduction and escalation of tariffs in early 2025, for nearly all imports, with rates reaching 27% by April, have driven revenue even higher. Through May 28, 2025, U.S. tariff receipts totaled about $68 billion, marking a 78% increase over the same period in 2024. Projections indicate these 2025 tariffs could generate between $150 billion and $300 billion annually, although estimates vary due to legal uncertainties and economic impacts.

Federal excise taxes—applied to goods like gasoline, alcohol, and tobacco—have shown greater stability and modest growth. Quarterly data up to Q1 2025 show excise tax receipts ranging between $93 billion and $95 billion (seasonally adjusted annual rate). IRS reports describe excise collections for FY 2025 as “a few billion dollars above expectations,” consistent with projected trends from the Congressional Budget Office. Unlike tariff revenue, excise taxes have not experienced dramatic spikes or volatility, maintaining a stable contribution to federal receipts since 2017.

In summary, tariff revenues surged from around $35 billion in 2017 to roughly $70 billion in 2019 and have further escalated in 2025, potentially totaling over $100 billion annually. Meanwhile, excise tax collections have remained stable in the low‑$90 billion range per quarter, with modest, predictable growth through mid‑2025. Meaning the experts done got shit fucked up in their estimates to date.

Although I can go into a couple of other economic indicators, I will close with wage growth. Blue-collar wage growth refers to the increase in wages or earnings over time for workers in blue-collar occupations. These jobs typically involve manual labor or skilled trades, and are commonly found in sectors like:

Manufacturing, construction, transportation, warehousing, agriculture, and stuff like that. Typically, it is measured over time (monthly, quarterly, annually) and is influenced by factors such as labor demand, inflation, and minimum wage laws. Example being, if average hourly earnings for warehouse workers rose from $20/hour in 2023 to $21/hour in 2024, that’s a 5% blue-collar wage growth.

This week, we just observed real wages for hourly workers increase nearly 2% in the first five months of Trump’s second term. This is the strongest growth in 60 years. The last time this happened for a president was under President Trump in his first term.

Economically, things are looking good for America. This is not to say they will stay on a positive trajectory or go bad. Either way, I will call it like I see it because my economic theory again is the “don’t have the loot, can’t spend the loot” theory. The youngins, especially the YN’s, have a saying - “On God, No Cap.” It is the 2025 representation of “I promise to tell the whole truth, and nothing but the truth, so help me God.” The Democrats keep showing us who they are. Inflation is not skyrocketing, and things are not going up in price. Gas is down, and wages are increasing. For months, economists have been saying that inflation will rise due to Tariffs. Hard to take them seriously at this point. On God - No Cap.

[SUBSCRIPTION DRIVE - HELP ME GET 10 NEW SUBSCRIBERS THIS MONTH]

PLEASE SUPPORT, RETWEET, & SUBSCRIBE

****NO TAX ON TIPS****

Bitcoin: 1EjeWTtFT8PnnHVLSncmgDyqiAznHnxoKz

Venmo: https://venmo.com/u/ttsphd

Dogecoin: DKBA3NHrYLcYfdTuSirV21doUbBxQKhdLn

Cashapp $tstephensphd or https://cash.app/$tstephensphd

Every donation to this Writer - be it $5, $50, $500, or more - is welcome and needed. A recurring contribution or sponsorship would be great.

FEEL FREE TO POST LINKS WITH OPPOSING VIEWS.

WORD OF MOUTH HELPS. JUST $5.00 A MONTH

.

Rising wages make a sound, and that sound is the wailing and lamentation of the investor class complaining about labor shortages.

Love it: "I have frequently wondered how a person can be dumber than Mazie Hirono. She is undoubtedly a row of crayons shy of a full box and is radically maladroit."

Good news about the economy. Can't depend on Democrats to understand it.